Keep ahead of the threat

Stay up to date with the latest mycotoxin information by signing up to our newsletter

Managing the mycotoxin risk in lower quality ingredients

Author: Martin Minchin, Marketing Manager | Alltech Mycotoxin Management

Click to listen to the Mycotoxin Matters podcast episode with Dr. Max Hawkins, hosted by Nick Adams, where they discuss the mycotoxin risk in lower quality ingredients, and what impact recent weather conditions have on various grains globally. You can also listen to the episode on Apple Podcasts or Spotify. You can find an edited transcript at the bottom of the page.

In a recent Feed Strategy article by Dr. Ioannis Mavromichalis, it was noted that some feed industry commentators suggest that corn could be heading for $10 per bushel ($390 per tonne). The USDA’s official forecast projects a price of $6.75 per bushel for 2022–2023, while $4.00 per bushel was seen as quite a high only recently. Across all key grains, prices remain at a stubbornly high level. For crop producers, these elevated prices are more than welcome, having suffered the effects of dramatic inflation and paying record high prices for key inputs like fertilisers, pesticides and fuel. However, feed and livestock producers using these ingredients to formulate animal diets are hoping for some stability to return to commodity markets. Despite higher output prices for milk and meat compensating for some of the higher input costs, margins continue to be squeezed tighter and tighter in livestock businesses across the globe.

What is behind the recent grain price increases?

What is driving these higher grain prices? If ever there was a time to use the term perfect storm, it feels very appropriate right now. The conflict in Ukraine is undoubtedly the leading contributor to the tighter grain stocks, or at least the expectation that this is creating amongst traders for harvest 2022 output. Over the past 10 years, Ukraine has grown in importance as a grain exporter, rising to third in wheat and fourth in corn. Reduced planting and significant disruptions to exports mean a large dent is being put in the availability of global grain stocks and comes on the back of a year that already saw acute tightness of supply and higher than average commodity prices. If the markets were hoping that other regions could make up some of the Ukrainian shortfall, they are unfortunately realising that this does not look like it will be the case. The USDA 2022–23 corn projection is expected to be 4.35% down on the previous year. Europe is becoming somewhat of a heatwave hotspot, with subsequent impacts on crop output. The FAO predicts that wheat production across the EU will be down by 10%, with France being severely hit, losing 20% of standard tonnage. In Northern Italy, a large corn-growing region, a state of emergency has been declared due to drought, with some farmers already harvesting corn that has not yet even tasselled, just to capture some forage. Adding to pressure on commodity availability, some crop producers have cut back on applications of fertilisers and pesticides to try and reduce their input bills and are prepared to sacrifice a certain yield level in return. In some regions, availability of these inputs has been the limiting factor, not price.

Are there any positive signs in the crop markets? The two countries faring better than in previous years are Brazil and Canada. Although still below the five-year average, Canadian output is expected to be up to 30% higher than last year if current growing conditions continue. In Brazil, second crop corn is performing quite well so far and may help replenish some of the shortfall there. Equally, as talks continue to try and reopen ports and grain shipping from Ukraine, progress here may provide some relief to those managing price and availability of key commodities.

The mycotoxin risk in lower quality ingredients

Amid such volatility, higher ingredient prices may not be the only area that feed and livestock producers should be concerned about. As the industry may be forced to use older stock grains that have been in storage for a long period, quality issues can arise, including the presence of mycotoxins that have developed during storage. Additionally, due to both price and availability of parent grains, producers are looking to include a greater level of cereal byproducts in their animal diets. Like old stock grains, the mycotoxin risk attached to the use of byproducts is elevated.

“When feeding large amounts of byproducts to animals, a trend that is common during periods of high material prices, we need to understand that there can be a tremendous level of variability in the quality of these feedstuffs,” commented Dr. Luke Miller, a ruminant technical support specialist at Alltech. “Byproducts tend to contain a large number of different types of mycotoxins from the Fusarium, Penicillium, Aspergillus or Claviceps families.”

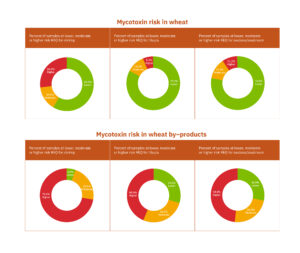

When byproducts from crops such as corn and wheat are produced, the mycotoxin risk is amplified as the mycotoxin presence contained in the parent grain is now concentrated into a lesser mass. This contrast in mycotoxin risk was very evident in a recent analysis of aquaculture feed ingredients carried out by Alltech. When Alltech’s Risk Equivalent Quantity (REQ) metric was applied to wheat and wheat byproducts, the percentage of ingredients at higher risk levels for shrimp was 27% and 74%, respectively (Fig 1.)

Figure 1: A comparison of mycotoxin risk in wheat and wheat byproducts used in aquaculture production.

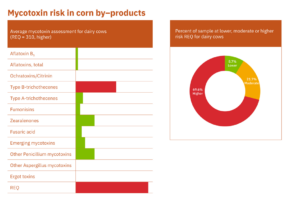

Similarly, an analysis of distillers dried grains tested by Alltech 37+® in the first six months of 2022 reveals the extent of the challenge associated with these ingredients. Each sample had an average of 9.7 mycotoxins, with type B-trichothecenes presenting the greatest risk (Fig 2.). In a dairy system, 70% of the samples analysed would present a higher-risk mycotoxin challenge. The potential challenges are highlighted using Alltech’s PROTECT™ Calculator that assesses the impact on animal health and performance associated with feeding such mycotoxin levels. At an average REQ level of 310 ppb, milk production is predicted to drop by over 0.5 litres per cow per day, with somatic cell count levels being increased. Dr. Miller notes that, in a dairy setting, although a reduction in milk production immediately draws attention, producers must also be aware of the impact on reproduction rates. He also adds that dairy cattle are one of the animal groups most susceptible to lower levels of mycotoxins due to production stresses.

Figure 2: The mycotoxin risk in corn byproducts analyzed at Alltech 37+ labs during the first 6 months of 2022.

The Alltech 37+ analysis also demonstrates the mycotoxin risk to broiler and grow-finish pig producers. The percentage of samples at higher risk is up to 90% in a swine setting, with the potential for reduced performance in herds consuming such contaminated byproducts.

How can feed and livestock producers manage the mycotoxin risk?

Are feed and livestock producers powerless when managing the potential risks from mycotoxins when using lower-quality grains or byproducts during the coming feeding season? They do not have to be, and although it is still pretty much impossible to eliminate mycotoxins from the animal feed supply chain, some steps can be taken — from when the crop is planted all the way through to the delivery of the feed to animals — that can help to mitigate the mycotoxin challenge. Knowledge is key, and one of the vital tools within this cycle is mycotoxin detection. Until the actual risk is identified and quantified in the ingredients that you are using, it can be very difficult to establish an effective mycotoxin control program or make successful use of in-feed solutions like mycotoxin binders that are designed to remove mycotoxins from the animal’s digestive tract before they have a chance to cause serious harm. Lab-based analysis typically identifies a larger group of mycotoxins, while field-based mobile testing provides a quick and cost-effective solution to identify some of the key mycotoxins that may be present in a sample.

Over the next few months, Alltech will provide comprehensive insights into the mycotoxin risk in newly harvested grains across Europe, the USA and Canada. To find out more about these programs, or if you are concerned about the quality of the ingredients you are using in your operation, please contact your local Alltech representative, who will be happy to help you understand more about managing the challenge.